What’s the difference between a home insurance inspection and a standard home inspection? While homeowners might be familiar with the idea of home inspections in general, it’s crucial to know how an insurance inspection can differ.

Here is a basic guide comparing home insurance inspections and standard inspections:

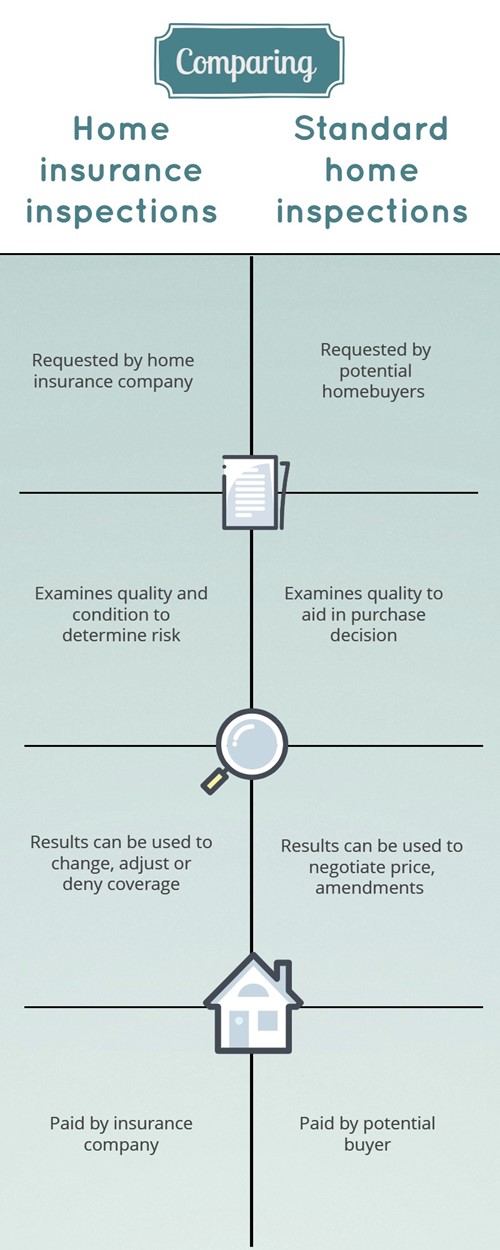

Home insurance inspections are required and carried out by the insurance company providing the homeowners insurance policy. Standard inspections, by contrast, are required by mortgage lenders during the homebuying process.

Lenders might not require homeowners insurance inspections, but you do need proof of insurance for final mortgage approval.

Insurance companies use inspections to determine the amount of risk associated with the client’s home. The inspectors examine the property to find potential liability issues associated with its condition or features. They can also use the inspection results to create an accurate valuation of the home to determine the correct amount of insurance coverage to recommend.

Standard inspections are more broadly used, but are most often used to influence and educate a homebuying decision. A standard inspection reports on the quality and condition of the home in many of the same ways. However, these inspections are more concerned with informing the potential buyer of any maintenance issues they otherwise wouldn’t discover until after moving in.

Home insurance inspections are typically free to the homeowner. The insurance provider pays the bill for the inspection itself, but the overall cost may be wrapped into the policy itself.

In the homebuying process, the buyer pays for the home inspection. In some cases, the seller might offer to pay for the inspection as part of a negotiation.

Both of these types of home inspection are something every homeowner is likely to deal with over the life of the property. The more you know about the differences, the more confident you’ll be in discussing the options with your provider.

I have lived in the Athol-Orange-Phillipston area for most of my life. I graduated from the Athol-Royalston Schools and Boston College in 1973. I have been an active real estate Broker since 1973.. I have First hand knowledge of all the various aspects of working and living in our area.

For over 40 years I have maintained a presence in the real estate market through building new homes while buying and selling all types of real estate. I offer first hand knowledge and experience to Buyers and Sellers in our unique market area . I also have a keen interest in Waterfront properties, land and income properties. We are also currently focused on bringing new businesses into our area including Commercial , Mixed Use and Retail Development along the Rt 2 corridor including into the North Quabbin Business Park and the Greater Gardner to Athol-Orange areas.

I will to give you the benefit of my training and experience and the most personal service and attention that you deserve.